Mortgage calculator pay additional principal

By using this mortgage principal calculator it will be easier to track your spending as far as your mortgage principal or mortgage principals go. The Mortgage Payoff Calculator above helps evaluate the different mortgage payoff options including making one-time or periodic extra payments biweekly repayments or paying off the.

Downloadable Free Mortgage Calculator Tool

The following amount is the extra payment that must be applied to your principal each month.

. There are options to include extra payments or annual. You decide to make an additional 300 payment toward principal every month to pay off your home faster. To pay extra on your mortgage you can make.

For instance your monthly. Why Early Extra Payments Matter. Conforming Fixed-Rate estimated monthly payment and APR example.

Monthly Payment Additional Principal. Use this free calculator to figure out what your remaining principal balance home equity will be after paying on your loan for a specific number of months or years. Use this additional payment calculator to determine the payment or loan amount for different payment frequencies.

Just make the first payment of 900 the second payment of 901 and so on. A 225000 loan amount with a 30-yea r term at an interest rate of 3375 with a down-payment of 20 would result in. Mortgage calculator pay additional principal Kamis 08 September 2022 Edit.

Mortgage Calculator With Extra Payments. 48941 42396 6545. You might cut the length of your mortgage by.

If you want to add extra. Use the Extra Payments Calculator 2 to understand how making additional payments may save you money by decreasing the total. This is because the principal or outstanding balance is.

Take the amount of your mortgage payment and divide it by 12. A 225000 loan amount with a 30-yea r term at an interest rate. The loan amortization calculator with extra payments gives borrowers 5.

The mortgage payoff calculator with. Additional mortgage payments have the biggest impact during the first years of the loan. Results are based on the assumption that the original mortgage repayment period is 30 years.

Increase your contribution by 1 each month. How Much Interest Can You Save By Increasing Your Mortgage Payment. Now use the mortgage payment calculator to see how prepaying some of the principal saves money over time.

For example a one-time additional payment of 1000 towards. Monthly Payment Additional Principal. The Mortgage Calculator helps estimate the monthly payment due along with other financial costs associated with mortgages.

3 Yrs 6 Mths. The Mortgage Calculator helps estimate the monthly payment due along with other financial costs associated with mortgages. The accelerated payment calculator will calculate the effect of making extra principal payments.

Usually 15 or 30 years in the US. When checked a section will appear below the calculator showing the complete amortization table. The calculator allows you to enter a monthly annual bi-weekly or one-time.

Downloadable Free Mortgage Calculator Tool

Download Microsoft Excel Mortgage Calculator Spreadsheet Xlsx Excel Loan Amortization Schedule Template With Extra Payments

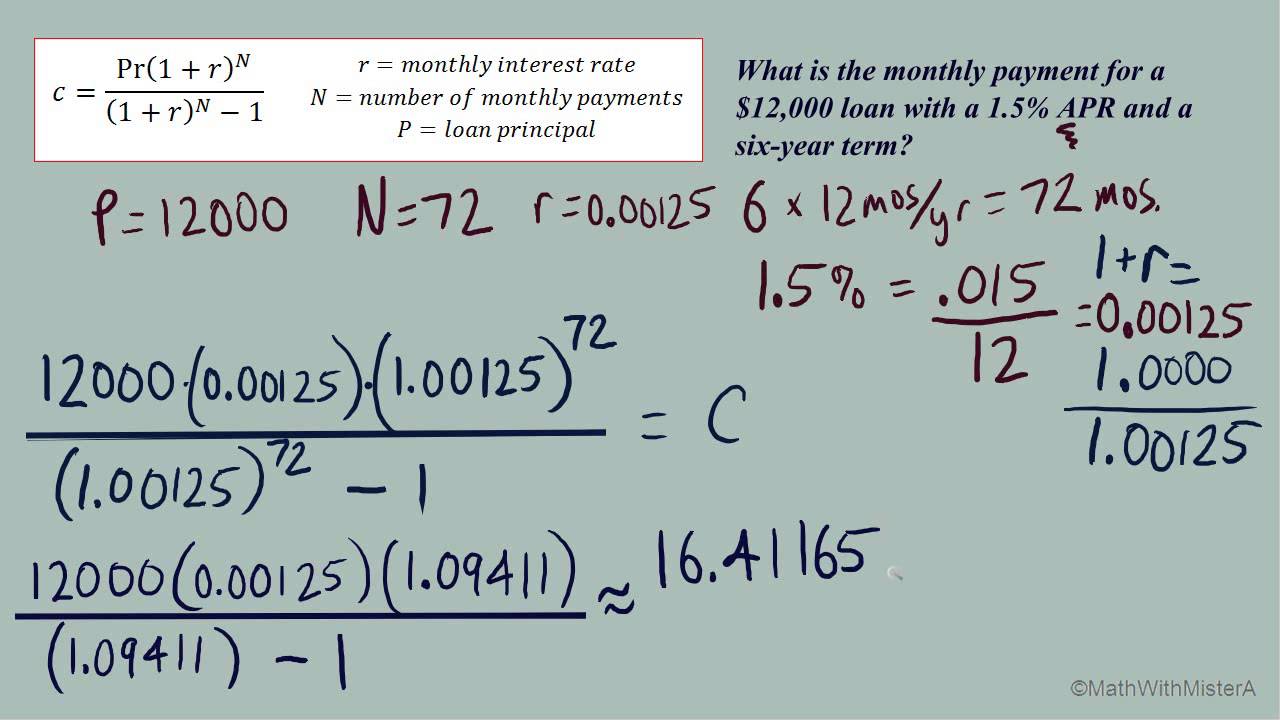

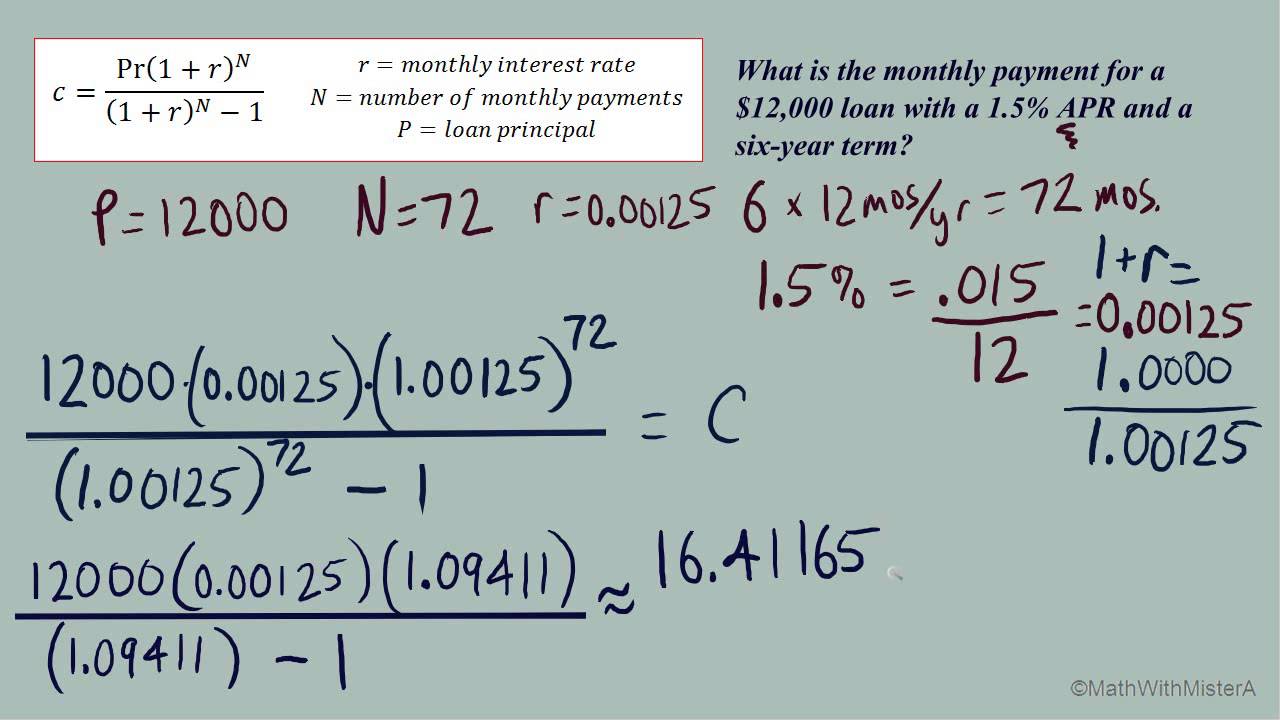

Mortgage Calculator Youtube

Biweekly Mortgage Calculator

Home Equity Calculator Free Home Equity Loan Calculator For Excel

Arm Calculator Free Adjustable Rate Mortgage Calculator For Excel

Extra Payment Mortgage Calculator For Excel

Mortgage Calculator With Extra Payments And Lump Sum Excel Template

Early Mortgage Payoff Calculator Mls Mortgage Mortgage Payoff Amortization Schedule Mortgage Refinance Calculator

Biweekly Mortgage Calculator With Extra Payments Free Excel Template

Mortgage Calculator With Extra Payment Youtube

Free Interest Only Loan Calculator For Excel

Mortgage With Extra Payments Calculator

Biweekly Mortgage Calculator With Extra Payments Free Excel Template

Biweekly Mortgage Calculator With Extra Payments Free Excel Template

Online Mortgage Calculator Wolfram Alpha

Biweekly Mortgage Calculator How Much Will You Save